Experian gives consumers quick and easy access to their credit reports. It is the leading provider of online consumer credit reports, credit scores, and credit monitoring.

Experian provides credit monitoring products to more than 3.1 million members. They have delivered more than 20 million credit reports online. This makes them a trusted name in the credit industry.

Why Choose Experian?

Experian offers many services. These include credit reports, credit scores, credit monitoring, and identity theft protection. Let’s look at why you should choose Experian.

Quick And Easy Access

Experian makes it easy to get your credit report. You can get your report online in just a few minutes.

Trusted Provider

Experian is the leading provider of online consumer credit reports. They have a long history of helping people with their credit needs.

Comprehensive Services

Experian offers a range of services. These include credit monitoring, credit scores, and identity theft protection. You can manage all your credit needs in one place.

What You Get with Experian

When you use Experian, you get access to many useful tools and services. Here is what you can expect.

Credit Reports

Experian provides detailed credit reports. These reports show your credit history and current credit status.

Credit Scores

Experian gives you access to your credit score. This is a number that shows how good your credit is.

Credit Monitoring

Experian offers credit monitoring services. This helps you keep track of changes in your credit report. You will get alerts if there are any changes.

Identity Theft Protection

Experian provides identity theft protection. This helps keep your personal information safe from thieves.

Financial Power in Your Pocket

Experian offers tools to help you manage your money on the go. You can get credit alerts straight to your phone. This is free with your membership and the Experian app.

Experian Smart Money™ Debit Card

The Experian Smart Money™ Debit Card is issued by Community Federal Savings Bank (CFSB). Banking services are provided by CFSB, Member FDIC. Experian is a Program Manager, not a bank.

How to Get Started with Experian

Getting started with Experian is easy. Here are the steps you need to follow.

- Go to Experian.com.

- Sign up for an account. You will need to provide some personal information.

- Once you have an account, you can access your credit report and other services.

Experian Boost

Experian Boost is a tool that can help improve your credit score. It works by adding positive payment history to your credit report.

Here are some important things to know about Experian Boost:

- Results will vary. Not all payments are boost-eligible.

- Some users may not receive an improved score or approval odds.

- Not all lenders use Experian credit files.

- Not all lenders use scores impacted by Experian Boost.

Frequently Asked Questions

What Is Experian Credit Report?

Experian Credit Report provides detailed information about your credit history and current credit status.

How To Get A Free Experian Credit Report?

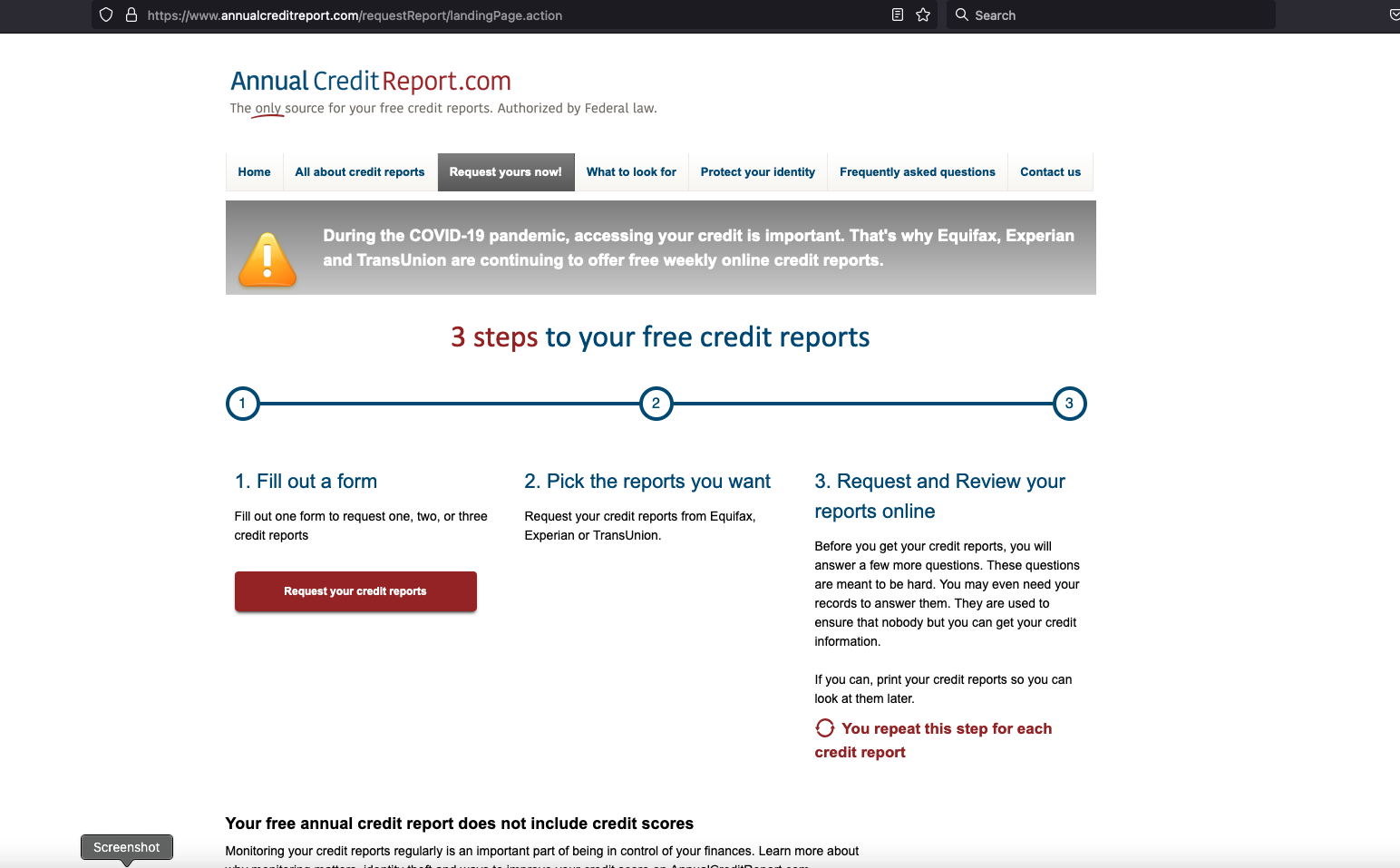

You can get a free credit report from Experian once every 12 months at AnnualCreditReport. com.

How Accurate Is Experian Credit Report?

Experian Credit Reports are highly accurate and frequently updated to reflect your latest financial activities.

Does Experian Offer Credit Monitoring?

Yes, Experian offers comprehensive credit monitoring services to alert you of any changes to your credit report.

Conclusion

Experian is a trusted provider of credit reports and credit monitoring services. They offer quick and easy access to your credit report. With Experian, you can monitor your credit and protect your identity.

Getting started with Experian is easy. Just sign up for an account on their website. Once you have an account, you can access all their services. Give Experian a try and take control of your credit today!